Middle Class Continues to Reduce Spending, Worried about Income Prospects

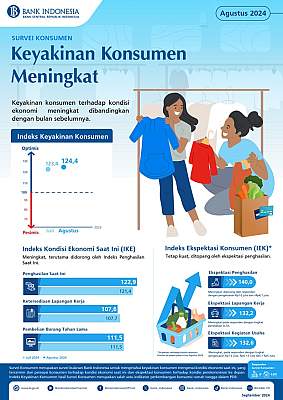

Indonesian consumers' expectations about the economic condition for the next six months have increased, as reflected in the Consumer Expectation Index (IEK) for August 2024. The index rose to the optimistic zone (>100), increasing by 1.6 points from 133.3 in July 2024 to 134.9.

According to Bank Indonesia's Consumer Survey for August 2024, released on Monday (9/9/2024), the strengthening of the IEK was driven by improvements in all its components. These include expectations about income, job availability, and business activities, which increased from 137.7 to 140.0, 131.7 to 132.2, and 130.5 to 132.6, respectively.

The sharpest increase in the IEK occurred among the lower (expenditure group Rp1-2 million), upper-middle (Rp4.1-5 million), and upper (>Rp5 million) income groups. In contrast, the IEK for the middle-income groups (Rp2.1-3 million and Rp3.1-4 million) declined.

The perception index on the availability of job opportunities in the next six months only increased for the high school education group, from 128.7 to 130.7. The groups with academy, bachelor's, and postgraduate education were pessimistic about the job availability, as reflected in the decline of their respective indices.

Expectations about future business activities increased among the lower (Rp1-2 million), upper-middle (Rp4.1-5 million), and upper (>Rp5 million) income groups, but declined for the middle-income groups (Rp2.1-3 million and Rp3.1-4 million).

In August 2024, consumers continued to reduce their spending, with the average propensity to consume ratio decreasing from 73.8% in July 2024 and 73.9% in June 2024 to 73.5%. The debt-to-income ratio and the saving-to-income ratio remained stable at 10.9% and 15.7%, respectively.

The decline in the consumption-to-income ratio was observed in the lower-middle (Rp1-2 million and Rp2.1-3 million) income groups, while the middle and upper-middle (Rp3.1-4 million and Rp4.1-5 million) income groups experienced a slight increase. The upper-income group (>Rp5 million) had the highest increase in consumption.